Building a Lasting Legacy: Essential Estate Planning for Women Entrepreneurs

- Womens Chamber of Commerce Miami-Dade

- Jul 15, 2025

- 4 min read

Updated: Aug 14, 2025

We're deep into our Summer Legacy Era at WCC, and if last month's conversation about building businesses that outlast us got you thinking, this one's going to push you into action. Because here's the uncomfortable truth: You can build the most impactful business in the world, but if you don't have the proper legal and financial structures in place, your legacy could disappear faster than a Miami thunderstorm.

Estate planning isn't just for people with trust funds and country club memberships. As women entrepreneurs, we're creating wealth, building assets, and establishing businesses that support families and communities. That makes estate planning not just important; it's essential.

We know talking about death and money in the same conversation feels heavy. But approaching it with intention and love for the people we're protecting? That's actually one of the most powerful acts of leadership we can demonstrate.

So queens, let's walk through this together, step by step, so you can secure everything you've worked so hard to build—for you, your family, your loved ones, and those who matter most.

The Importance of Estate Planning for Entrepreneurs

When you're building a business, you're not just accumulating personal wealth; you're creating an entity that employs people, serves clients, and generates ongoing income. Without proper planning, your business could face:

Immediate operational chaos if something happens to you

Tax burdens that could force the sale of business assets

Legal battles among family members about business decisions

Loss of key business relationships and client confidence

Financial hardship for employees and their families

Your estate plan needs to address both your personal assets and your business interests. Think of it as the ultimate business continuity plan that protects everyone you care about.

Step 1: Document Your Complete Asset Portfolio

Before you can protect what you've built, you need to know exactly what you have. This goes beyond just listing your checking account balance.

Step 2: Create Your Will (Yes, Even if You're Young)

A will is your foundational document that dictates how your assets will be distributed after death. For entrepreneurs, this document needs to address both personal and business considerations.

Common Will Mistakes Entrepreneurs Make:

Failing to update after major business changes (new partnerships, acquisitions, etc.)

Not addressing business-specific assets like client contracts or intellectual property

Choosing an executor who doesn't understand business operations

Not coordinating with business partnership agreements

Step 3: Establish Power of Attorney Documents

Power of attorney documents ensure someone can make decisions for you if you become incapacitated. For business owners, this is crucial for maintaining operations during emergencies.

Choosing Your Agent:

Business Financial POA: Consider someone who understands your industry and business operations.

Healthcare POA: Choose someone who knows your values and will advocate for your wishes.

These can be the same person or different people depending on their skills and availability.

Step 4: Select Beneficiaries and Guardians Strategically

Your beneficiary designations need to reflect both your personal relationships and business realities.

Step 5: Set Up Trusts for Business and Personal Assets

Trusts offer more control and flexibility than wills alone, especially for business owners with complex asset structures.

Trust Benefits for Entrepreneurs:

Business continuity during transition periods

Tax optimization for business income and growth

Creditor protection for business and personal assets

Privacy for business valuations and succession plans

Step 6: Plan for Business Succession

Your business succession plan is arguably the most critical part of your estate planning as an entrepreneur.

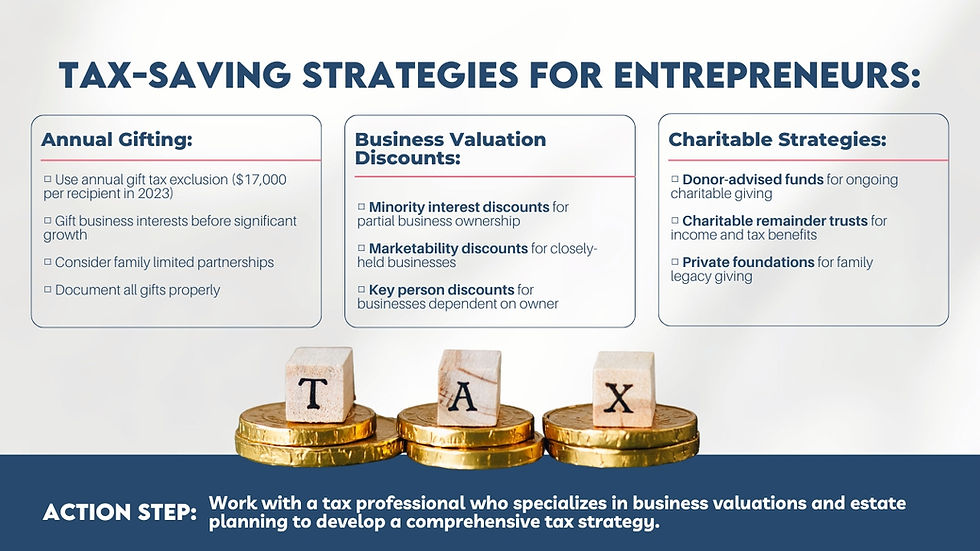

Step 7: Optimize for Estate Taxes and Gifting

Smart tax planning can significantly increase what you're able to pass on to your beneficiaries.

Your Estate Planning Expert: IRAMA VALDES, P.A.

If you're ready to move beyond the basics and create a comprehensive protection strategy, Irama's expertise in estate planning for entrepreneurs, families, individuals, and beyond could be exactly what your legacy needs.

Connect with Irama Valdes, P.A and her team below:

HER OFFICES

12485 SW 137th Ave Suite #201 Miami, Florida 33186

(754) 339-1882

Your Estate Planning Action Timeline

Having the Conversation That Matters

Estate planning isn't just about documents; it's about communication. Your family needs to understand your intentions, your business partners need to know the succession plan, and your key employees need to feel secure about their future.

Making These Conversations Easier:

With Your Family:

Frame it as protection and love, not mortality.

Be clear about your business values and vision.

Explain how the business supports the family's future.

Address concerns about business involvement vs. personal inheritance.

With Your Business Partners:

Discuss succession scenarios openly.

Agree on business valuation methods.

Create fair buy-sell agreements.

Plan for both voluntary and involuntary departures.

With Your Team:

Communicate stability and continuity.

Explain how succession planning protects their jobs.

Involve key employees in succession planning.

Create retention strategies for critical team members.

Remember: These conversations get easier with practice, and the peace of mind they provide is invaluable.

This summer, as we continue our Legacy Era theme, commit to taking these seven steps. Your future self, your family, your business partners, and your community will thank you for the foresight and love you put into protecting what matters most.

Comments